Request Venture Capital Search Quote

WinStar® Venture Capital Searches have been used for all phases of venture investing.

Global early stage venture investment showed deepest decline compared to all other stages in 2023. Funding up to Q3 totalled $23.4 billion down 38% year over year. Seed funding also declined 27% from $9bn to $6.6bn showing funding continues to slow and demonstrating the need to research, qualify and secure investors who have a strong strategic interest.

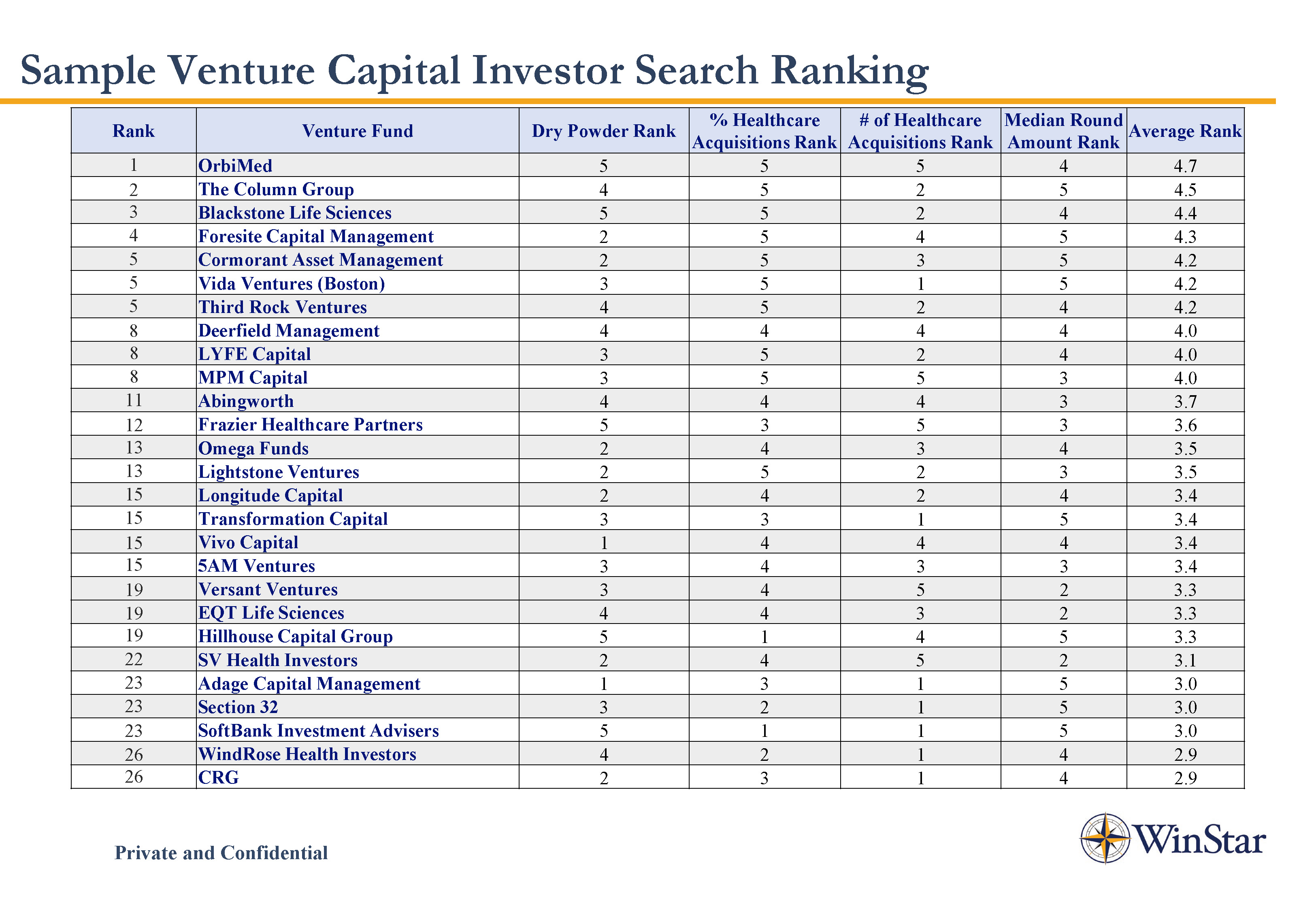

Each WinStar® Venture Search includes Venture Capital Funds, Family Offices, Special Purpose Acquisition Companies (SPACs)and Strategic Corporate investors. WinStar® Searches are specific to the company sector, illustrate comparable investments made by the sponsors and provide a ranking so that executives may proceed efficiently in their quest for capital.

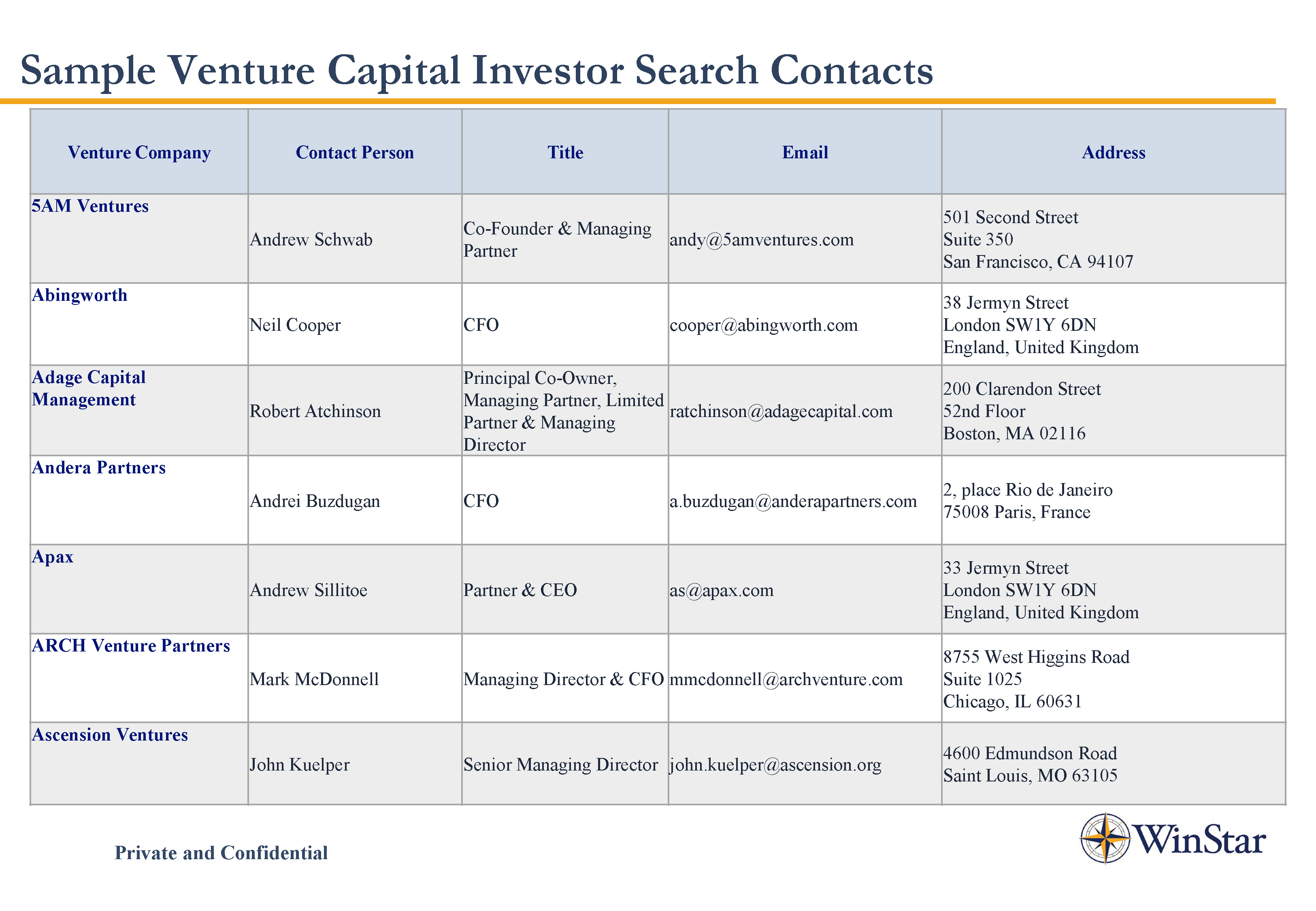

Each Search is compiled by a team of experts and can be delivered within (30) days. Searches include the names, addresses and direct contacts of all venture investors. Institutions use Venture Searches when evaluating a potential project for commercialization. Venture Searches are provided on a fixed fee basis which allows the Client to undertake their own capital raising and each engagement is quoted independently.

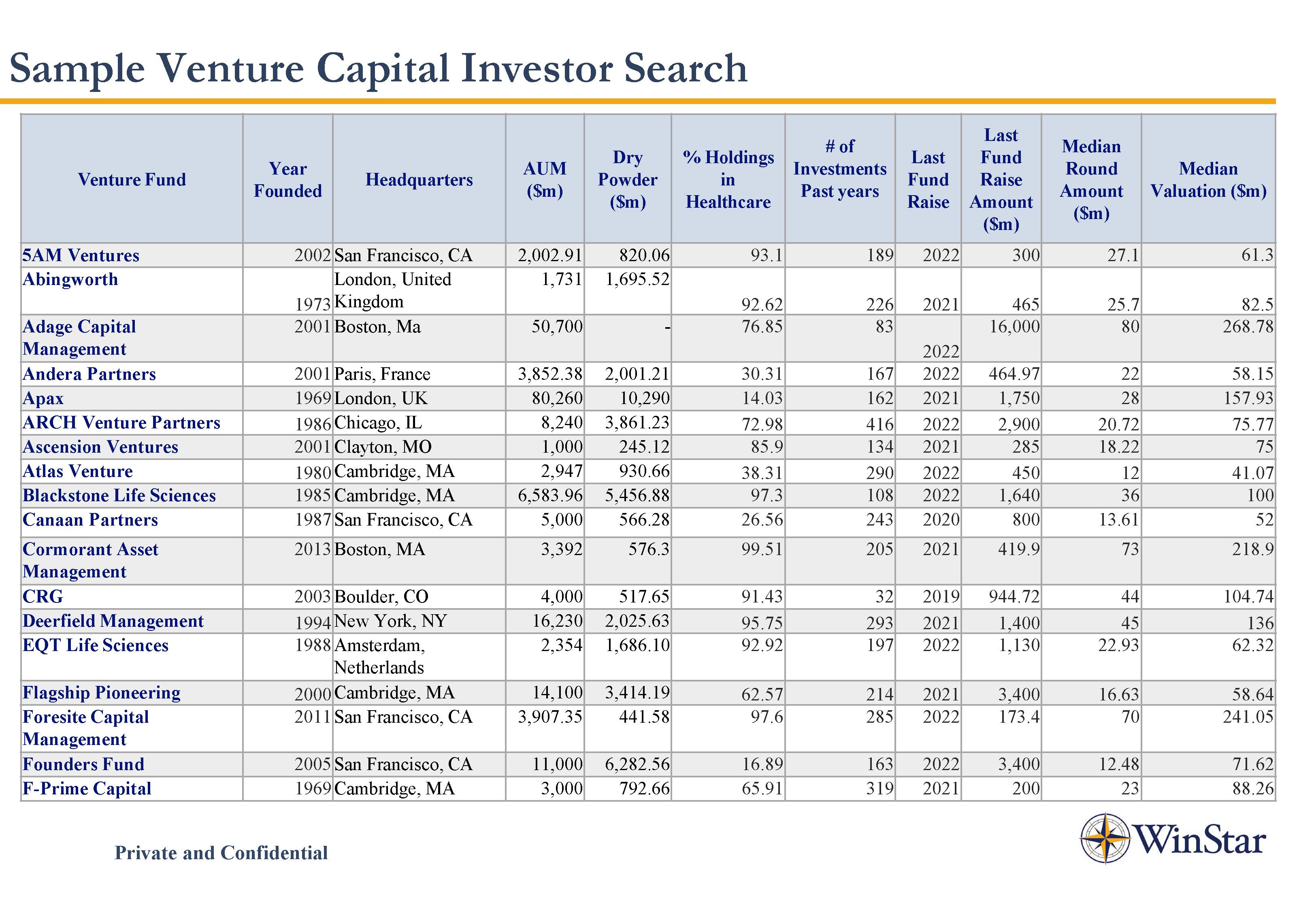

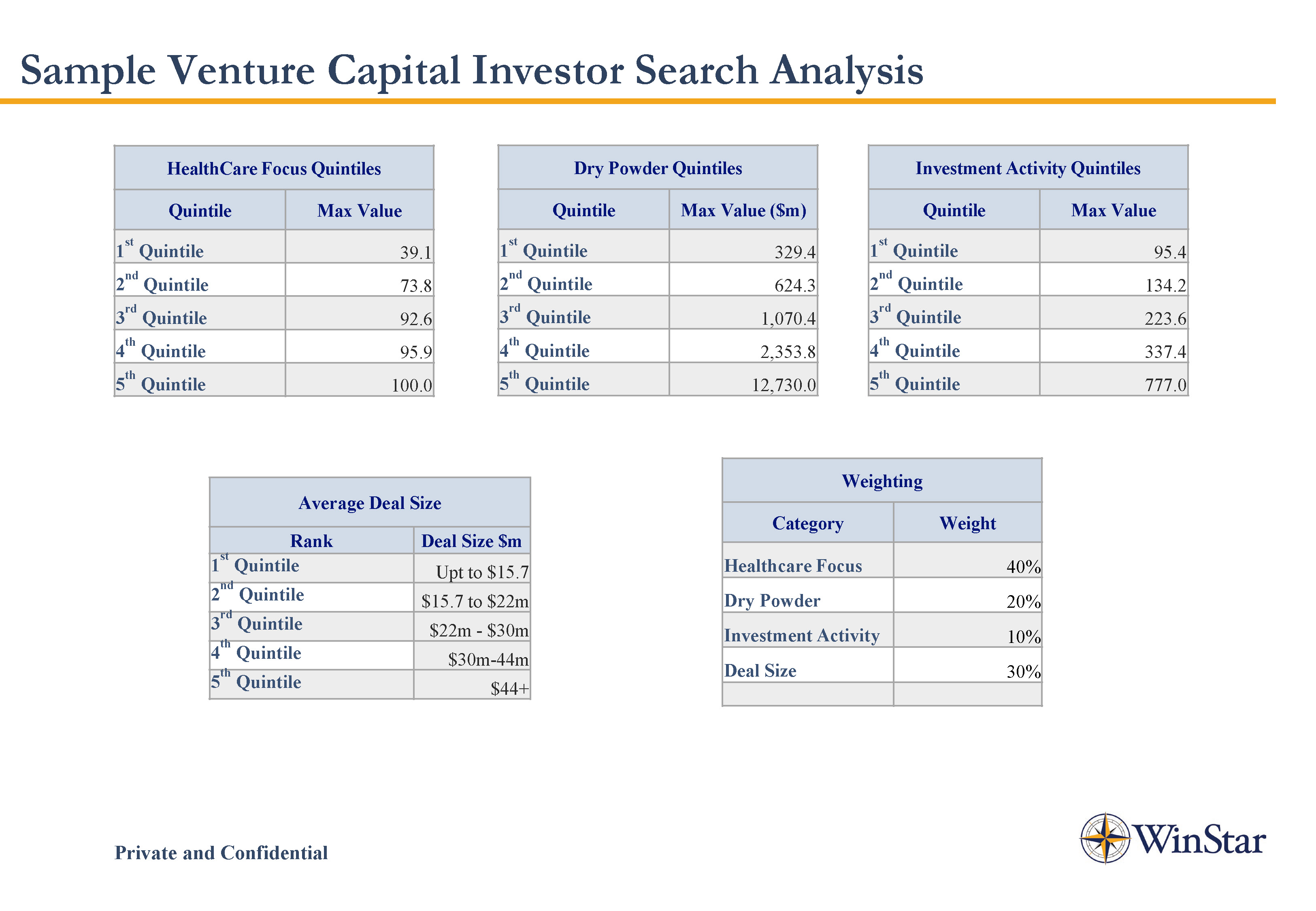

Each Search includes qualifying details for potential capital investors with up-to-date data on the size of the fund, sector activity, median investment size, dry powder and email contacts.

See sample Venture Search pages: